sales tax calculator anaheim

You can print a 775 sales tax table here. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Inheritance Tax On House California How Much To Pay And How To Avoid It

TAX DAY NOW MAY 17th - There are -416 days left until taxes are.

. This is the total of state county and city sales tax rates. Sales Tax calculator Anaheim Fill in price either with or without sales tax. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

Just enter the five-digit zip code of the location. California State Sales Tax. For example the state rate in New York is 4 while the state sales tax rate in Tennessee is 7.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. For tax rates in other cities see Puerto Rico sales taxes by city and county. Use one form for all the states where you need to register.

Put your rates to work by trying Avalara Returns for Small Business at no cost for up to 60 days. There is base sales tax by California. - Single standard deduction one exemption - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median home price - Car taxes assume a new Honda Accord costing 25000.

There is no applicable city tax. View More Data. Find list price and tax percentage.

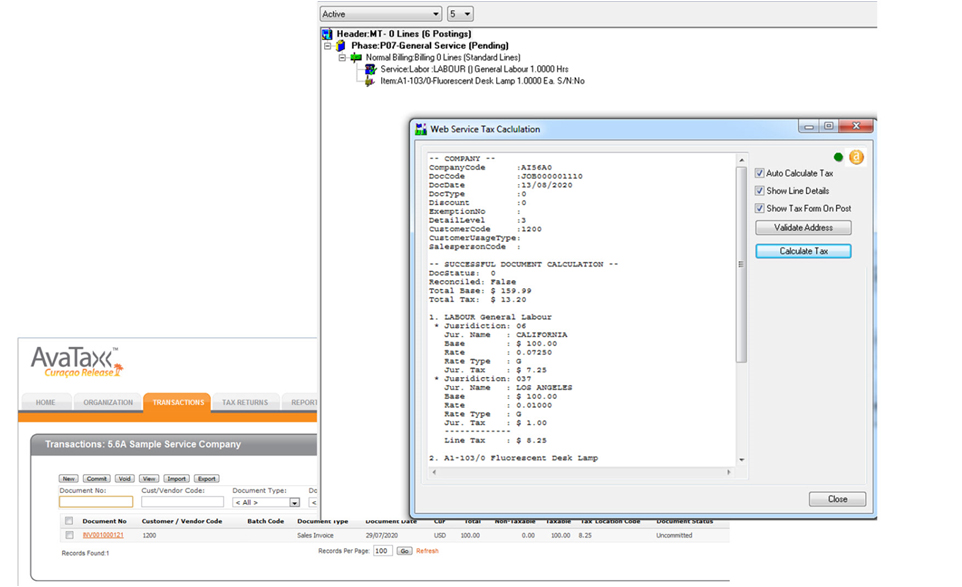

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Some areas may have more than one district tax in effect. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

States use sales tax to pay for budget items like roads and public safety. Counties cities and districts impose their own local taxes. Anaheim CA Sales Tax Rate.

The 775 sales tax rate in Anaheim consists of 6 California state sales tax 025 Orange County sales tax and 15 Special tax. Total Sales Tax Rate. Local tax rates in California range from 015 to 3 making the sales tax range in California 725 to 1025.

Counties cities and districts impose their own local taxes. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Anaheim CA. What salary does a Sales Tax Manager earn in Anaheim.

This is the total of state county and city sales tax rates. Fill in price either with or without sales tax. These usually range from 4-7.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. Chula Vista CA Sales Tax Rate. Liberty Tax is a full service income tax preparation company.

The state sales tax rate is the rate that is charged on tangible personal property and sometimes services across the state. There is no applicable city tax. Calculator for Sales Tax in the Anaheim.

Simplify your sales tax registration. Sandras Income Tax Svc. Method to calculate Anaheim sales tax in 2021.

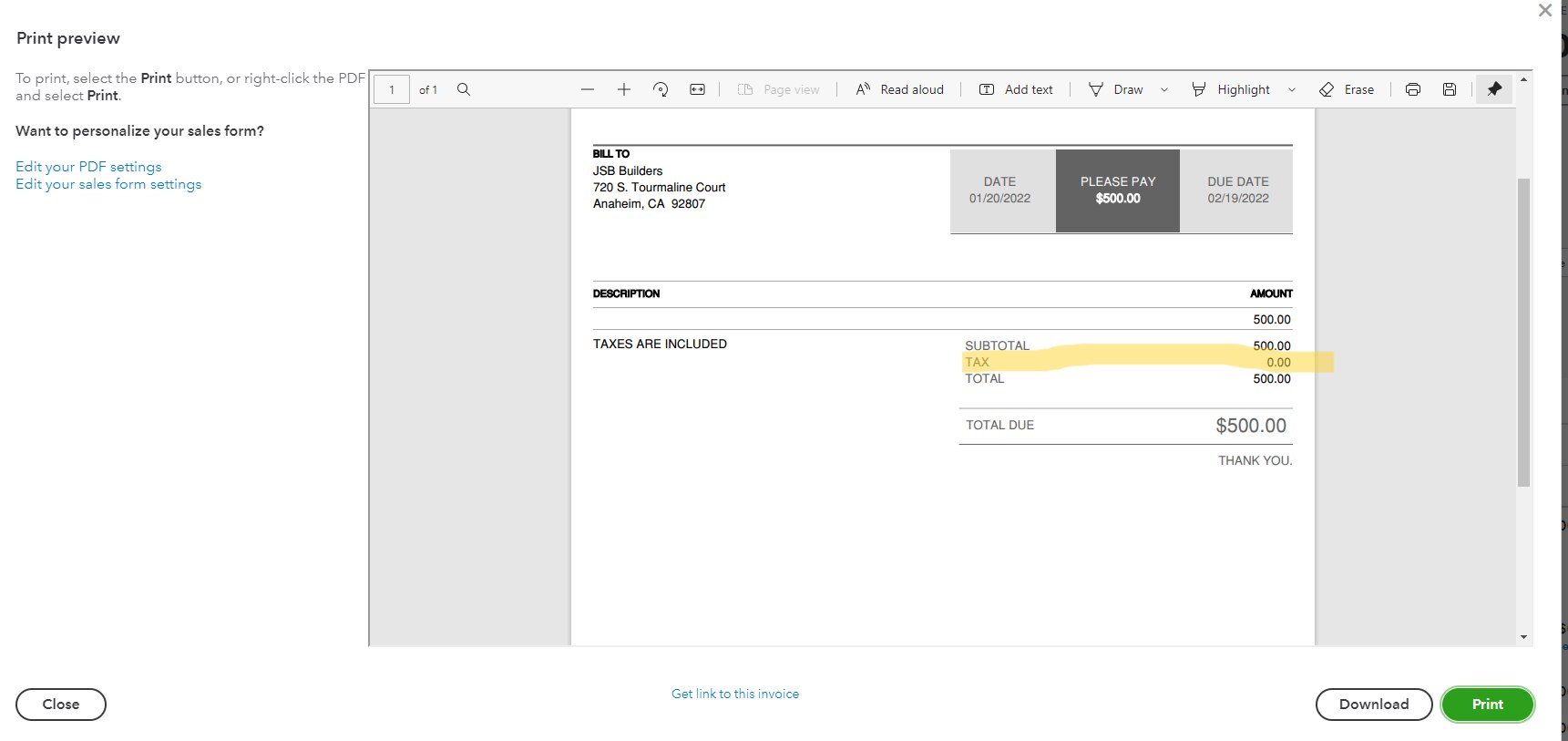

Price before Tax Total Price with Tax - Sales Tax. Price wo tax. Fresno CA Sales Tax Rate.

Look up the current sales and use tax rate by address. The 775 sales tax rate in Anaheim consists of 6 Puerto Rico state sales tax 025 Orange County sales tax and 15 Special tax. Those district tax rates range from 010 to 100.

If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. Tax info is updated from https. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations.

Then use this number in the multiplication process. The results are rounded to two decimals. Calculator for Sales Tax in the Anaheim incorporated.

As we all know there are different sales tax rates from state to city to your area and everything. Bakersfield CA Sales Tax Rate. 2022 Cost of Living Calculator for Taxes.

Some areas may have more than one district tax in effect. How to Calculate Sales Tax. The Anaheim sales tax rate is.

The 775 sales tax rate in Anaheim consists of 6 California state sales tax 025 Orange County sales tax and 15 Special tax. Visit your local Anaheim CA Liberty Tax office for professional friendly tax preparation help. Sellers are required to report and pay the applicable district taxes for their taxable.

Sales Tax Calculator. US Sales Tax California Orange Sales Tax calculator Anaheim incorporated. You can print a 775 sales tax table here.

17 Sales Tax Manager Salaries in Anaheim provided anonymously by employees. The results are rounded to two decimals. Avalara provides supported pre-built integration.

Quickly learn licenses that your business needs and let Avalara manage your license portfolio. There is base sales tax by California. Sales Tax Rate Sales Tax Percent 100.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Maximum Local Sales Tax. Price before Tax Total Price with Tax 1 Sales Tax Rate.

Sales Tax Calculator Sales Tax Table. Identify and apply for business licenses. The Anaheim sales tax rate is 0.

Start filing your tax return now. Rates include state county and city taxes. Anaheim California and Dallas Texas.

2020 rates included for use while preparing your income tax deduction. The County sales tax rate is 025. The base state sales tax rate in California is 6.

The 775 sales tax rate in Anaheim consists of 6 California state sales tax 025 Orange County sales tax and 15 Special tax. Divide tax percentage by 100 to get tax rate as a decimal. The mandatory local rate is 125 which makes the total minimum combined sales tax rate 725.

175 lower than the maximum sales tax in CA. The statewide tax rate is 725. Multiply the price of your item or service by the tax rate.

Our free online Alabama sales tax calculator calculates exact sales tax by state county city or ZIP code. There is base sales tax by Texas. How to use Anaheim Sales Tax Calculator.

Maximum Possible Sales Tax. The minimum combined 2022 sales tax rate for Anaheim California is 775. The current total local sales tax rate in Anaheim CA is 7750.

The California sales tax rate is currently 6. 3008A W Lincoln Ave. Average Local State Sales Tax.

For tax rates in other cities see California sales taxes by city and county. The latest sales tax rates for cities in California CA state. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. Quickly learn licenses that your business needs and let Avalara manage your license portfolio. The average sales tax rate in California is 8551.

The December 2020 total local sales tax rate was also 7750.

Sales Tax Anaheim Tax Services Ca

California Sales Tax Increase Irvine New Sales Use Tax Rate

How Taxes Affect Nhl Salaries Stats And Stuff

Understanding California S Property Taxes

California Sales Tax Increase Irvine New Sales Use Tax Rate

California Sales Tax Increase Irvine New Sales Use Tax Rate

Property Tax Calculator Casaplorer

Property Tax Calculator Casaplorer

Sales Tax Anaheim Tax Services Ca

Food And Sales Tax 2020 In California Heather

Avalara Tax Calculator Service Order Manager

California Sales Tax Rates By City County 2022

How Much Are Taxes And Hotel Fees In Anaheim Ca Lexingtondowntownhotel Com

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax